Texting is one of the most commonly used forms of communication in the workplace. In regulated industries, using text messages for official business can be problematic, especially in the financial industry where the SEC and FINRA govern how firms archive text messages. Fines and penalties can be huge.

In this article, we’ll look at some of the biggest FINRA and SEC texting fines and how they could have been prevented.

Understanding FINRA and SEC Texting Fines

Knowing how the SEC and FINRA and SEC treat text messages is crucial for maintaining compliance.

While both oversee and regulate financial markets, their approach to texting violation fines differs.

When it comes to FINRA texting fines, they are imposed based on a set of factors including:

- The severity of the violation,

- The harm caused to investors,

- The benefit gained by the perpetrator, and

- The firm’s violation history.

These fines are often part of a broader disciplinary action, which may include suspensions or additional sanctions.

On the other hand, SEC fines for texting are federally enforced against institutions that manipulate the market and commit corporate fraud.

In the texting context, the SEC assesses its penalties based on the following factors:

- The harm done,

- The nature of the violation,

- The size of the institution, as well as

- The compliance history.

There is no set amount a firm will be fined because the fines are based on multiple factors.

Recent FINRA and SEC Texting Fines

Here are some recent FINRA and SEC texting fines:

The Wall Street incident

In 2023, the US regulators fined nine Wall Street companies including Wells Fargo $549 million over their employees using off-channel communication via text and WhatsApp messages.

The incident was a huge breach of the SEC requirement to retain all work-related communications. The firms had not established any controls over how employees used personal devices or did not archive text messages at all.

All nine firms admitted that their employees had been communicating on personal devices since 2019. This revealed a four-year gap in record-keeping, which made the severity of the SEC’s fine even greater.

It’s easy to see that the incident could have been avoided by proper employee training. The firms should have enforced the policy stating that work-related communication is only allowed over employer-vetted channels and company-issued devices.

FINRA suspensions

In 2023, FINRA imposed a 15-month suspension as well as a $15,000 fine on a former Edward D. Jones & Co. broker because they sent client documents to another individual at the firm via SMS.

By sending messages that contained business-critical information on their personal phone, the employee bypassed the firm’s data retention policy and the messages were never archived.

Because of this, the investigation couldn’t prove if the employee’s violation was accidental or malicious. FINRA decided to act.

There are many similar cases when FINRA suspended and fined individual brokers for texting.

Huge SEC texting fines

In 2022, 16 Wall Street firms were fined a whopping $1.8 billion by the SEC over their employees using private texting apps.

The SEC uncovered that the agency engaged in “pervasive off-channel communication” and was keeping its communications records away from the SEC’s eyes, engaging in trades.

This was one of the biggest fines issued by the SEC regarding texting violations.

Not only were the firms fined, they were ordered to prevent future violations of record-keeping provisions and were censured.

The Most Common Texting Fines Trends

When it comes to FINRA and SEC texting fines, they can be divided into two categories:

Fines and penalties over the use of private devices and messaging apps:

- Personal device use — Many violations arise when employees use personal devices for business communications. This leads to unmonitored and unrecorded exchanges, making it difficult for firms to adhere to compliance standards.

- Messaging apps — WhatsApp, Bloomberg, and Signal add another layer of complexity. These platforms offer convenience and immediacy, but they create significant compliance challenges due to their encrypted and private nature.

- Blurring lines between personal and professional — The trend towards remote work has blurred the lines between personal and professional communications, further complicating oversight and record-keeping.

Fines for inadequate record retention:

- Failure to archive — Many firms don’t effectively archive text messages and digital communications in a comprehensive way required by regulatory bodies like FINRA and the SEC.

- Lack of oversight — In many cases, firms lack sufficient oversight mechanisms to ensure that all digital communications are captured and archived.

- Technological challenges — As technology advances it’s becoming harder to adapt and ensure all systems and policies are in line with compliance requirements.

How Archiving Solutions Solve the Problem

The key to compliance and avoiding FINRA and SEC texting fines is a holistic approach to data archiving.

Most financial firms are already aware of the importance of email archiving. However, topping it off with text messaging archiving can put an additional burden on the firm terms of systems and resources. Vendor lock-in is common.

For financial services firms, a text message archiving solution should:

- Offer standalone archiving of text messages, in case a firm already has a separate email archiving system which they are not planning to migrate.

- Offer integrated text message archiving with email, social media, Bloomberg, and other official channels used for communication. This approach is advised because it allows you to search all communication records from a single system, saving time and resources.

- Be able to archive text messages and calls from company-issued, CYOD, and BYOD phones.

Jatheon allows you to unify the archiving of text messages, phone calls, email, Bloomberg, WhatsApp, and social media. It’s also possible to retain only text messages.

Once archived, your text messages will be indexed and available for ediscovery.

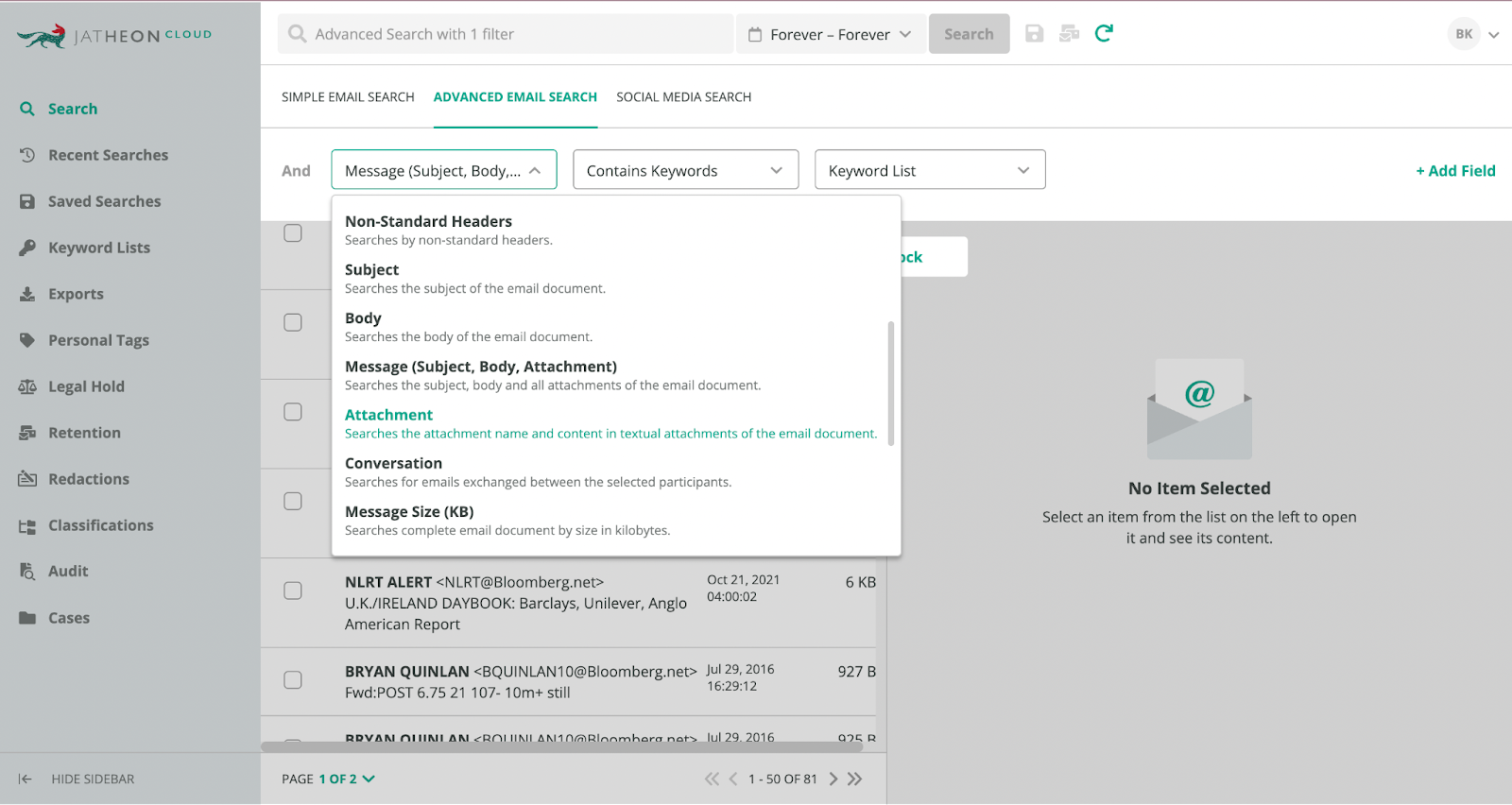

With advanced filters like keywords, phrases, proximity, fuzzy, and boolean operators, Jatheon helps you find the records you’re looking for in minutes and acts as a safety net that will prevent expensive litigation and help you keep your employees in check.

Once found, you can easily prove message integrity, making the records viable evidence in any court case.

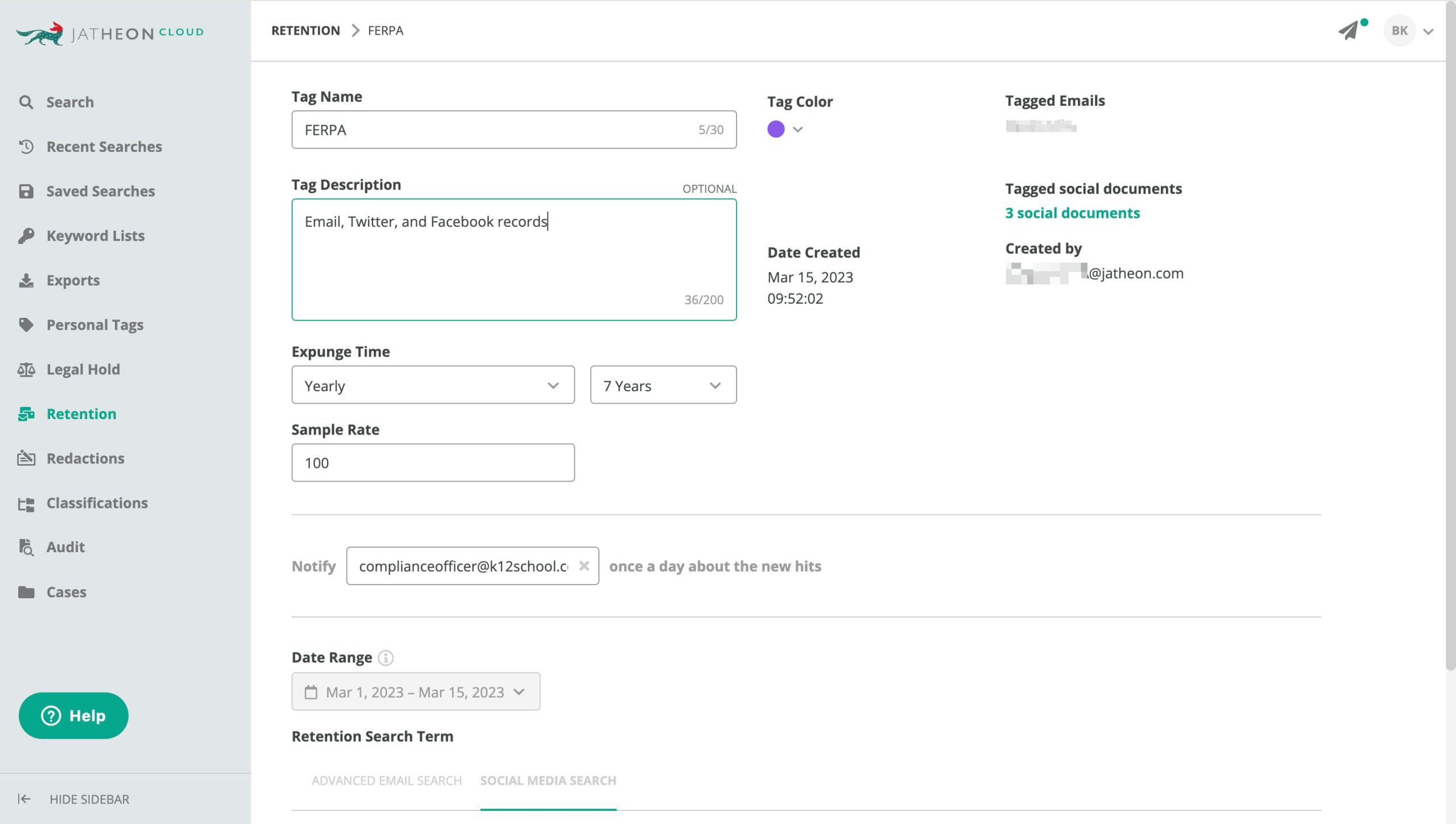

Along with this, you can create custom data retention policies to manage automatic data deletions.

Stay compliant with major data retention laws with Jatheon’s cloud email archiving solution. Capture data automatically, find important information, and manage your data with ease.

Stay compliant with major data retention laws with Jatheon’s cloud archiving solution Capture data automatically, find important information, and manage your data with ease.

Read Next:How to Meet FINRA Compliance and Retain Records in Line With SEC 17a-4 GLBA Compliance Checklist for Financial Services Why Archiving Text Messages and Mobile Communication Is So Important |